- Credit and you may monetary files: We help you prepare your economic data, increase credit ratings, and boost your loan application to get to know bank criteria.

To finance their mini home, you need to sign up for an interest rate from a loan provider. This requires delivering documentation including proof of earnings, credit score, and you may downpayment. The lending company uses this short article to evaluate your debts and you may dictate the loan eligibility.

- Proof earnings: This may are shell out stubs, tax returns, or other documentation one verifies your earnings.

- Credit file: Most loan providers require a credit report appearing your credit score and you may get. We can make it easier to safe funding even with an adverse rating.

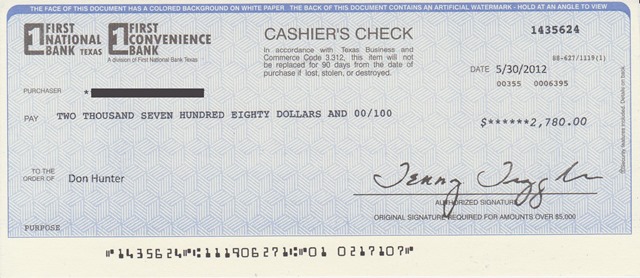

- Down-payment: Quite often, you ought to have a down payment saved, that is a portion of your price.

- Identification: Proof name, instance a license or passport.

- Assets information: Factual statements about brand new mini house you intend to get, for instance the purchase price and property review.

Exactly why do You desire A home loan having a micro House?

A home loan to have a small household opens up options to possess reasonable way of life if you are allowing you to invest in assets. Financial support alternatives make it easier to manage your funds and permit that get a mini family versus burning up your own savings for the the method.

- Advance payment: It’s difficult to spend an entire price of a house upfront. Home financing enables you to use the remaining number and you will spend it right back throughout the years.

- Homeownership: A home loan enables you to own their mini-household, which can render a feeling of balances and coverage.

- Investment: Purchasing a mini residence is an important investment. Assets values generally increase over the years, and you may make security because you pay-off the borrowed funds.

Pick Service Dependent Lightweight-Home financing

If you’re considering entering homeownership for the first time, a micro quarters will be the best choice to help you get foot from the home. Rather, if you are intending in order to downsize, an inferior place to name family is just what you might be looking for. Now, many people are looking at all their selection and you may and also make smart options that match the specifications, and we have been right here to help make they you can easily that have lightweight domestic money solutions which might be custom to you.

The best part? We caused it to be an easy task to supply lenders currently used to the exceptional framework functions. You might not have to convince them you to strengthening with our company was an audio suggestion. They might be currently onboard while they know the quality of the brand new property i would is first rate.

Apply at us to speak about submit-thought possibilities that enable you to inhale lifetime to your sight to your finest warm household. Arrive at the agents today to agenda an obligation-totally free session fulfilling.

Exactly how a small-Home Funds Broker Will bring an inconvenience-Totally free Financing Feel

Since the strengthening mini-home is actually a comparatively the brand new design you to definitely observes a modern framework collaborate in the place of a foundation underneath it, it may be challenging to persuade conventional lenders to finance the requires americash loans Hayneville.

We take away the challenge about picture insurance firms a great pre-established circle off acknowledged credit people one to comprehend the property value providing safe and sensible construction options to those who need to become free from significant financial-costs debt.

Name our team to arrange a consultation to find out more on what we could do to connect you to your resource you need to create your fantasy household.

What you need to Discover To purchase a tiny Home

If the strengthening otherwise purchasing a little home is your own goal, there are certain things you need to know before you get started. Including, are you aware you’ll funds a micro home which have less than perfect credit? We want the ability to define how we make it possible with alternatives for signature loans, Camper funds, mortgage loans, and you may builder money.