For the an earlier blog post, We noted several options that your home loan company you’ll promote in the event the youre at the rear of on your costs and you can looking to end property foreclosure. Of them solutions, financing modification is usually the most powerful and you can prominent device provided. It gets monthly payments straight back on the right track and has those individuals money sensible.

- This particular article relates mainly in order to homesteaded properties from the condition regarding Minnesota.

- A homeowner is making reference to late mortgage payments towards the earliest some time and plans to hold the household.

- Not one of one’s adopting the information is legal services. Be sure to talk to a professional attorneys regarding case of bankruptcy or other legal issues.

Working with losses mitigation

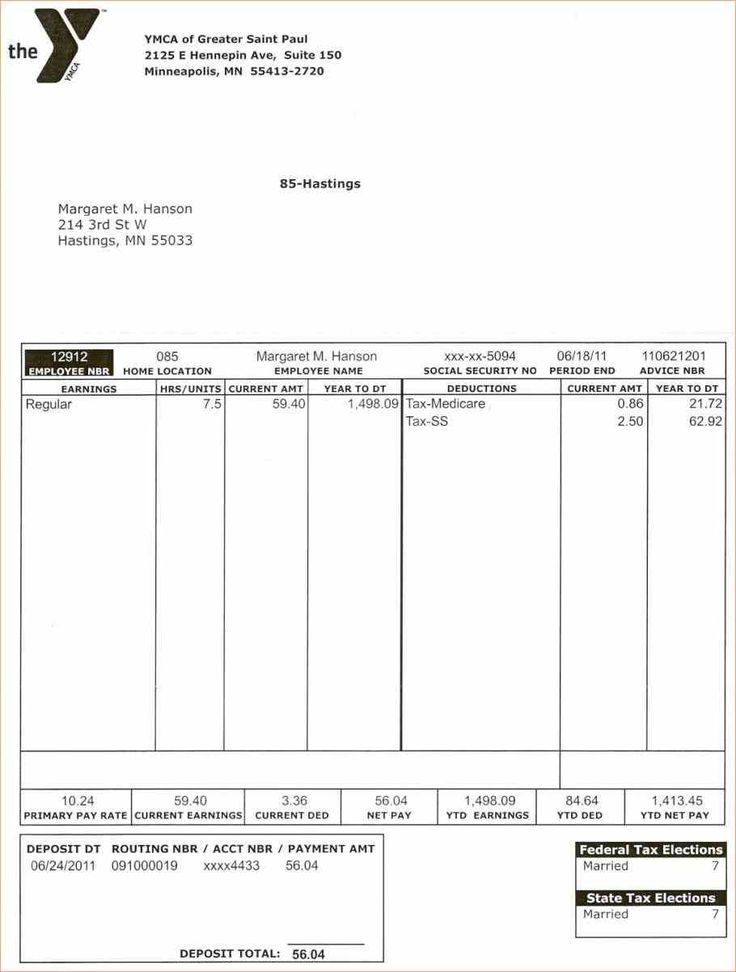

For folks who demand an amendment, losing minimization company at the mortgage lender generally speaking works closely with you. You are going to submit an application having financial assistance, fundamentally called the losses minimization packet. It could additionally be known as borrower guidelines function, work-out packet otherwise hardship packet. The borrowed funds business always needs their latest spend stubs and you may lender comments. Moreover it wants duplicates of 1 in order to one or two years’ worth out of taxation statements otherwise becomes your own consent to pull the extremely previous production.

Submit the documents thoroughly, and you can posting loss minimization the latest asked information promptly. Then check in with them frequently to ensure he has what you they need.

- To receive an amendment, you generally need to show that your existing financial hardships often boost down the road. Say, such as, your suffer an accident otherwise enjoys a medical-associated experience and you will skip money this is why. You later get well and are now returning to works. In this instance, there can be a good chance that lender often tailor your loan.

- The possibility disappear notably if you find yourself in the an intense, lasting financial crisis otherwise hardship otherwise there isn’t any proof a current, steady income. Including using jobless pros, because they are considered brief earnings. Probably the vow away from coming earnings (e.g., are hired to possess yet another jobs or implementing a job which one to is repaid the trail) is not sufficient; you have to produce actual spend stubs first.

- Homes rates can play as well as a massive part. This proportion ‘s the monthly homeloan payment separated from the homeowner’s gross income. Historically, the home Sensible Amendment System has established good 31% homeloan payment-to-earnings proportion as a benchmark whenever modifying mortgages. If your ratio is less than 31%, the financial institution you certainly will think that you can afford and come up with regular monthly premiums. In place of receiving a customized mortgage, might rather need cure investing various other section in order to pay the mortgage repayment. If your proportion try more than 31%, it would be evidence that the mortgage payment results in their hardship, and you can likely to be located a modification.

Capitalization

For every mortgage repayment that you skip would be added to good past-owed amount. The total earlier-owed amount will often be capitalized. This is why previous-owed money was set in the principal balance of your home loan, and full home loan number increases. Forgiveness of any of the a fantastic loans is actually uncommon.

Escrow scarcity

Whenever property fees and homeowner’s insurance are included in the newest monthly mortgage payment, they are listed in an escrow account. Whenever a homeowner misses costs, the borrowed funds providers can sometimes keep paying toward escrow account towards homeowner’s account, particularly property fees. As a result, an enthusiastic escrow lack, that the citizen need to pay right back.

Whether your homeowner’s insurance plan lapsed because you overlooked money, the mortgage team can occasionally place you inside good force-place insurance rates plan to restore your lapsed rules and keep your house covered. Force-placed insurance policy is tend to a bit more pricey than the standard homeowner’s plan. Thankfully, you could (and must) alter the push-put rules with your own insurance coverage in the event that of course the borrowed funds are changed.

An approach to keep costs sensible

That go to this web-site loan amendment isn’t helpful for people who end up being latest to your the mortgage, your costs are not sensible. Hence, possibly the loan organization lowers the rate to the home loan.

The business may additionally increase brand new go out in the event that financial try arranged to-be repaid, technically called an excellent name expansion. Particular people could be worried about a changed financial with a this new 29-12 months or even an excellent forty-season identity. However, that it expansion will help you stay-in your residence and continue maintaining your payments reasonable. You can always create even more repayments to your the primary, that slow down the mortgage name.

Immediately following a modification, the borrowed funds business you will request that you pay the escrow shortage entirely. It was tough to pay for a large lump sum, therefore mortgage organizations usually allows you to pay back new escrow scarcity over a period of 60 days.

Pre-trial and final mortgage loan modification

When you have gone through all the a lot more than methods, and losses minimization find one a modification could get the mortgage back on course, there is certainly commonly a pre-trial months. This might be a specific time period, normally 3 months, in which you have to improve the latest commission one losses mitigation determines. It is a test to see as possible resume and then make home loan repayments.

To make on the-date pre-trial payments is crucial so you’re able to signing your loan modification. If you are not able to exercise, the borrowed funds amendment procedure you are going to begin all over, and there’s zero make certain that the mortgage team usually once again offer this one.

Once you result in the last pre-trial commission, you are going to receive a final amendment contract to signal and you can time. It takes some time to help you processes, however modification is successful, you ought to begin getting month-to-month comments once more exhibiting the latest fee number. Having continued toward-go out payments, your credit history will soon let you know the loan just like the current. Most importantly, your house is not at risk of foreclosure.

The new amendment procedure can be frustratingly slow. Will still be diligent yet , vigilant for the chatting with the loss mitigation department on process.

Have the give you support you desire

LSS Monetary Counseling is here to help Minnesota residents which have 100 % free, expert property foreclosure reduction counseling and you can recommendations. If you’re for the MN and are usually worried about your mortgage payment, call in order to plan your own totally free mobile course or inquire any questions.

When you find yourself outside MN, go online to track down a good HUD-acknowledged, local counseling company. Just remember that , most of the HUD-accepted counseling is free of charge. Never ever purchase assistance with your own home loan.

This post is the following when you look at the good three-part series with the property foreclosure reduction. Simply around three, I could talk about the foreclosures processes alone as well as strategies to reduce the techniques.

Welcome

Welcome to Feel & Centsibility, the official blog getting LSS Economic Counseling, where you are able to learn about economic subject areas and get tips and tips. More about your site .