- The home must be seriously interested in a permanent basis you to definitely suits HUD criteria (new Company away from Housing and you may Urban Creativity).

- Re-finance a cellular home with a mortgage lender when the called because a property rather than since personal property.

- You should individual the fresh new home your residence is you to definitely. (You could potentially re-finance a cellular household on rented land that have a beneficial personal bank loan when needed.)

How to Become The newest Name

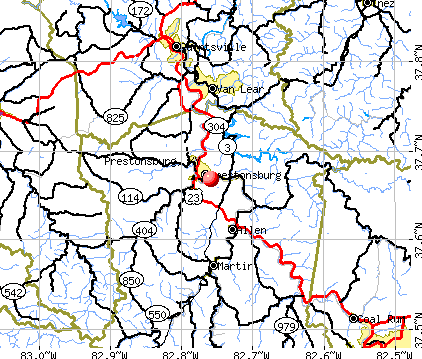

Specific says make it simpler to transfer your personal property identity to help you a bona-fide estate title. There had been alter to your statutes here within the La, MD, MO, NE, ND, TN, and Virtual assistant. This new regulations during these states got made it better regarding exactly what home is indeed a house and you will what is actually not. This will be making it easier discover headings converted.

A beneficial a house lawyer otherwise label providers and you may lawyer should be able to assist you with getting your label converted. That is the 1st step of getting the loan refinanced toward a lowered rates.

- Certificate out-of label with the home otherwise a duplicate of your certificate regarding resource of the home

- Deed into the belongings where the house or apartment with a permanent base is positioned

When you yourself have the genuine property term in your give, then you definitely will have to get a hold of a home loan company that may make you financing on the a made or cellular household. After you perform, the process doing the borrowed funds is like that have a good normal home.

Book House

Not as much as minimal circumstances, are designed people will get home financing to the a home with a leased lot. The newest FHA now offers the latest Name We program. It is made for residents that have property toward a long-term foundation however the residence is based in a produced houses community.

- The new mobile domestic has to be the majority of your home

- Your house must be into accommodations possessions web site that means the FHA mortgage guidance

- The new rent arrangement is to standards set because of the FHA

You have to know it is hard to find cellular family parks you to see FHA financial conditions. Discover partners landlords that can manage the brand new Label I system. And you will couple lenders package for the Identity step 1 mortgages, however, a whole lot more are getting on it year from the year.

Whether your cellular otherwise are produced house is called since your individual possessions, you pay individual assets fees. If it is called just like the property, you’ll pay a house taxation. In most states, its higher priced to pay personal possessions taxes.

You will need to do the mathematics on your own condition so you can observe far might cut having a lower interest rate which have a mortgage loan. Then you must contrast exactly how much a lot more of an income tax costs you may possibly have by paying a property taxes, or it may be quicker. As well as, you should shape in conclusion can cost you, and that is step 3-4% of amount borrowed.

As well as, if you must have a permanent basis to refinance your own chattel loan, this could charge you up to $fifteen,000.

Depending on the Federal Financial Information, Fannie mae announced something new providing 30-12 months financial investment getting are formulated land. If this sample goes well, we are able to anticipate Fannie to extend the applying to another forty two states too. Federal national mortgage association keeps a lengthy history of backing modular and you will are created mortgage brokers having sensible rates and you can terms and conditions.

Old-fashioned Are made House Refinancing

The newest Fannie mae MH Virtue and you may Freddie Mac computer ChoiceHOME programs are available for multiple-depth are Rockville loans formulated residential property which can be built to increased top quality basic than simply earliest HUD standards. These house be much more roomy than typical are formulated household refinancing and you can are made to end up like site-created domiciles a lot more directly.