Within the larger city centres or in suburbs discover near to biggest towns in Ontario possess lenders that will wade while the higher because the 85% as well as 95% financing to help you well worth when it comes to a home security financing Toronto. Niagara Drops and Grimsby is types of most other a great developing actual home places where home owners would have the means to access more substantial pool of security built lenders once they go through its seek the proper option for domestic collateral fund. As the most inhabited state into the Canada, Ontario poses an incredibly attractive marketplace for personal mortgage loans and personal loan providers giving a whole lot more aggressive repaired prices and you can terminology, plus in specific rarer times variable price alternatives, loan places Ignacio than just comparable loan providers various other real estate markets all over Canada. Assets viewpoints is actually less likely to go-down inside Ontario than simply they are various other provinces inside Canada, and when they do, they’re going to most likely not go-down really fast or for too much time. As a result, costs on the mortgages and you may domestic security fund is going to be down also.

As a result of the highest fixed rates which might be common with of numerous household equity loans and you will second mortgage loans. it is crucial that you create certain that you have got an excellent good package positioned about precisely how you plan to use, repay, and you may do the latest funds that’s made available to you. An excellent experienced mortgage broker will you with this area of the equation.

In recent years, and given the not the new COVID-19 pandemic, people who own their home and you can the or knowledgeable business owners was increasingly looking at new security that they have found in their house as the a supply of dollars. This is accomplished since the throughout situations where the business business was forced to romantic and individuals is actually forced to be home more toward lockdown, money is lowest while fixed costs including lease, assets tax, individual income tax, credit card debt, and even certain varying expenditures is also will still be about undamaged. Its during these times when individuals who own their residence you’ll take advantage of expert advice and you may suggestions of a reliable home loan elite group dedicated to home mortgages. Reach out and make contact with a mortgage broker who can make it easier to discover the most suitable choice to suit your as well as your family members’ needs.

You should understand how a new house collateral loan normally both assist in improving your financial situation, plus the way it can lead to injury to your finances if not treated properly. We are going to look at the positives and negatives which come having domestic equity money additionally the house collateral personal line of credit activities.

The loan so you’re able to worthy of takes into account the balances that may getting due towards the all mortgage loans and you may domestic lines of credit associated with the subject property due to the fact brand new home loan are processed in addition to fund was given with the borrower

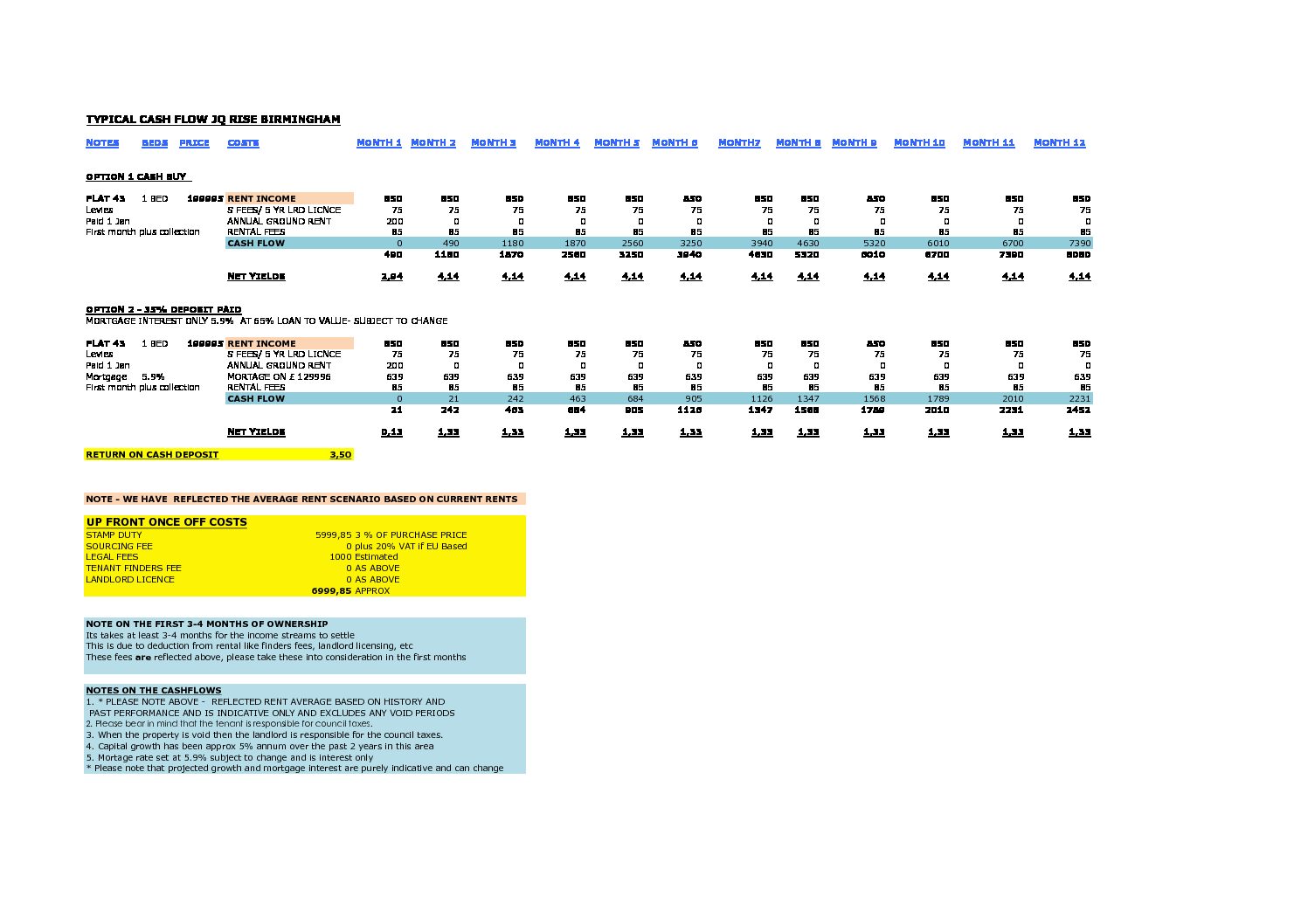

Let me reveal a chart you to shows the very best household guarantee mortgage costs inside Ontario to support your pursuit.

How much cash might you borrow secured on a house security financing?

What kind of cash which may be borrowed courtesy property security loan hinges on multiple circumstances. Any of these issues for instance the location of your home, the matter and you can ages of your residence, and also the exactly what the brand new LTV could be adopting the guarantee loan are financed.

In the Clover Mortgage we can representative domestic equity financing you to definitely diversity only $29,000 to help you all the way to $a hundred,100000,100 and more, so long as the lender’s conditions try fulfilled hence there is certainly enough guarantee kept for sale in the house that’s unencumbered immediately following the home financing is provided. Let’s face it, you will be making a somewhat high financial and you may lives decision and you will need to know what your choices are.