Are you currently desperate to very own a property of? In the event that’s your perfect, you are most likely protecting upwards, money by tough-earned dollars, if you don’t get that miracle matter: 20% of your own fantasy home’s complete value towards advance payment. That’s what the advantages say, correct?

On the mediocre Western house, 20% amounts in order to a fairly large number. Throw in closing costs and you have tons of money in order to boost and years commit unless you reach finally your purpose.

It’s great that you’re placing currency out on the what is going to probably be the premier purchase of everything, but there is that grand error in your calculations: You don’t have to generate an effective 20% deposit.

Yes, your understand right. Brand new 20% myth are a sad remaining regarding the time following houses crisis whenever out-of necessity, entry to borrowing fasten. Thank goodness, times keeps altered, and because FHA loans were launched more than 80 years back, mortgage loans haven’t required a good 20% advance payment.

While it is correct that a high deposit function you have an inferior month-to-month mortgage payment, you will find some good reason why this isn’t always the best road to homeownership.

Why don’t we speak about loan alternatives that don’t need 20% off and take a further look at the positives and negatives of creating a smaller deposit.

Financing options

step one.) FHA financial: It loan aims at enabling basic-date home buyers and requirements only step 3.5% off. If that matter has been too much, the fresh downpayment will be acquired of an economic provide or through a downpayment Advice program.

dos.) Virtual assistant mortgage: Va mortgages would be the really flexible, but they are strictly to own newest and former army people. They need zero down, do not require home loan insurance policies in addition they allow for most of the closing costs ahead from a merchant concession otherwise provide fund.

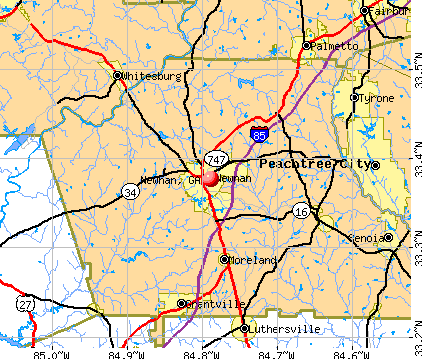

step 3.) USDA mortgage: Such money, supported by the united states Institution off Farming, also require no off, however, qualification try location-situated. Qualifying property doesn’t have to be situated on farmlands, nonetheless they have to be in sparsely populated elements. USDA loans are available in the fifty says and are also given because of the extremely loan providers.

step 1.) 3% off financial: Of several loan providers often today offer mortgages with consumers placing only a small amount just like the step three% off. Specific loan providers, including Freddie Mac computer, actually offer reduced financial insurance policies on these finance, and no income limits with no basic-big date buyer requisite.

2.) 5% down home loan: Plenty of loan providers allows you to establish merely 5% off a great house’s worthy of. However, really demand that household become consumer’s primary quarters and you may that the customer has actually a great FICO rating off 680 or even more.

step 3.) 10% down home loan: Really lenders can help you sign up for a traditional financing with 10% down, even after a faster-than-top credit history.

Bear in mind that each one of these funds needs income eligibility. Additionally, getting lower than 20% down usually means that investing in PMI, or personal home loan insurance coverage. not, for folks who have a look at your house just like the a secured asset, using your own PMI feels as though paying for the an investment. In fact, centered on TheMortgageReports, some residents have spent $8,a hundred in PMI throughout ten years, and their home’s worthy of has grown because of the $43,one hundred thousand. That’s a giant return on the investment!

Whenever you are thinking of wishing and saving if you don’t provides 20% to put down on property, think about this: An effective RealtyTrac data unearthed that, typically, it can get a home visitors nearly 13 many years to save to own good 20% down-payment. In most that time, you might be building your own collateral and you may home values will get increase. Cost more than likely commonly also.

Most other advantageous assets to putting down less than 20% range from the after the:

- Conserve dollars: You should have extra cash available to dedicate and you may rescue.

- Pay back financial obligation: Of many lenders highly recommend playing with readily available bucks to spend down credit card personal debt before purchasing a property. Credit debt usually has a top interest rate than just mortgage financial obligation therefore wouldn’t internet you a taxation deduction.

- Change your credit history: Once you have paid debt, anticipate to visit your score surge. It is possible to house tax refund cash advance emergency loans 2022 online a far greater home loan price like that, particularly when your get tops 730.

- Remodel: Pair property can be found in finest standing since the considering. You will likely need to make some alter to your brand new home before you can relocate. Having some funds available to you makes it possible to do this.

- Make an emergency finance: As a resident, with a proper-stored disaster funds is extremely important. From this point on the, you’re going to be one using to resolve one plumbing system items or leaking roofs.

Downsides away from an inferior deposit

- Home loan insurance coverage: A beneficial PMI percentage try a supplementary month-to-month expenses loaded over the top of financial and possessions tax. As previously mentioned over, regardless of if, PMI is going to be a good investment.

- Potentially high mortgage prices: While you are taking right out a conventional loan and you will and work out a smaller sized downpayment, you may keeps a high home loan speed. But not, if you are taking out fully a government-recognized financing, you may be guaranteed a diminished home loan rates even with a smaller-than-strong deposit.

- Shorter guarantee: You will have quicker collateral in your home which have a smaller sized off fee. Of course, unless you are going to sell within the next long time, this cannot have concrete influence on your own homeownership.

However, this does not mean you can purchase a house no matter what much or exactly how nothing you really have on your checking account. Prior to which choice, ensure you can really afford to individual a house. Preferably, their complete month-to-month construction can cost you is to add up to less than twenty eight% of one’s monthly revenues.

Prepared to buy your dream family? We’d choose to assist you! Call us during the United Texas Borrowing Partnership right now to realize about the big home loan software and you may cost. We will take you step-by-step through as high as this new closure!

Your Change: Have you ever purchased a home and place lower than 20% down? Express the expertise in united states regarding the comments!