LPPSA: The facts?

To shop for a home into the Malaysia will likely be hard, because you can probably stumble on multiple dilemmas. Refuted loans away from bankers was one of several prominent cases. Better, what other alternative would you need certainly to in the long run seize their family?

If you find yourself an authorities personnel trying get a different sort of assets, this information is for you. Lembaga Pembiayaan Perumahaan Sektor Awam (LPPSA), or even known within the English as the Personal Markets Home financing Panel, try a homes financing program aiming to without difficulty give houses financing getting societal business group, bridging the fresh new pit between assets cost and you will acknowledged loan amount. It appears to be the way it is not everyone has heard with the helpful incentive as the 53% of government employees are still renting.*

Hence, this informative guide will assist you to understand what precisely is actually LPPSA and also the standards to put on, its app procedure, and most importantly, their gurus.

LPPSA isnt entitled to all developments

It is important to observe that not totally all developments can be seen as a result of LPPSA. It scheme generally speaking serves bodies-possessed and domestic-titled developments.

Characteristics you to bring industrial headings, on top of that, are usually maybe not subject to LPPSA money. Therefore, it might be advantageous to first check with brand new designer out-of the property to make sure that the desired house is officially entered according to the LPPSA design.

eight Form of Fund from the LPPSA

You imagine that LPPSA simply offers fund to acquire a good new home. However,, that is not all the! That it system doesn’t only simplicity the entire process of to acquire an effective upcoming domestic household to have public service experts, as well as discusses other kinds of homes fund, given that placed in the latest contour lower than:

Benefits associated with LPPSA

Why you need to make an application for LPPSA as opposed to the standard bank loan? Really, given that a municipal servant, you could potentially rejoice because the procedure for trying to get a property loan is a lot easier to you to that to possess individual specialists/group less than a binding agreement. The newest desk below shows the fresh new testing away from professionals anywhere between LPPSA mortgage and you can financial loan.

Thus, you can not only submit an application for a full loan, you could including obtain for a bit longer (doing 90 yrs old) during the LPPSA. What is better yet: the pace could become repaired at the 4% than the bank loans that have drifting interest rates according to BLR. Generally speaking, brand new stretched the loan period several months, the greater the speed over the years. However, lower than LPPSA, not only will you delight in lower monthly payment costs until you reach 90 years old, the speed will stay undamaged into the mortgage months!

Curious to try to get a combined home loan with your partner otherwise children however they are not in the public industry? Don’t worry! Together with MBSB Bank Bhd, LPPSA has the benefit of spouses, moms and dads, and you will pupils to try to get a provided financial, on reputation one at least one of your combined candidates is actually a federal government staff.

During the convenient words, people government slave can apply to have home financing lower than LPPSA, while their moms and dads, partner or students (that doing work in the personal market) can buy money out-of MBSB Bank. Such as for instance, in the event that a community markets staff manages to see a RM 350,000 loan to own a property worthy of RM 400,000, brand new mate, moms and dads, or pupils who happen to be individual-market employees are eligible to submit an application for yet another loan you to definitely normally protection for the remaining balance (RM 50,000) away from MBSB Bank.

Thus, causing the list of experts revealed up for grabs more than, it mutual a home loan strategy can aid in reducing your own month-to-month resource commitments (due to the fact repayments is actually split between combined individuals) and you can get an elevated number of investment than the personal home loans!

App Requirements

- Feel an excellent Malaysian resident

- Be a federal government worker having a permanent updates

- Already found a jobs confirmation page

- Provides at the least one year out-of service

- Fill in the application form one year ahead of retirement/stop from solution

- Has actually legal counsel since the an observe into Conversion and buy Arrangement (SPA)

- Were a wedding certificate getting

- Shared a home loan on the companion, or

- Funds which might be registered from inside the combined (2) names lower than Spa

Just how LPSSA functions

From the dealing with this new table below, you can understand limit number of mortgage you could potentially use centered on your own net income:

Once you’ve had new green light for a houses loan, you will then proceed with the action-by-step technique to make an application for LPPSA, the following:

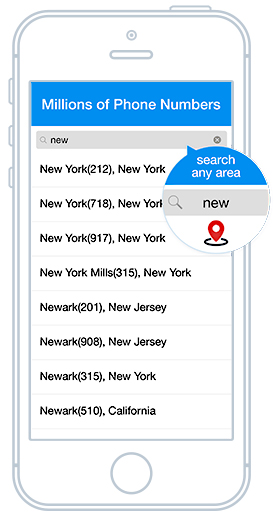

Good news! When you find yourself the kind https://paydayloanalabama.com/leesburg/ of person who enjoys economic abilities close to your hands, LPPSA has developed a mobile MyFinancing application to allow quick and easy usage of the financing account. With this specific software, you can examine your:

LPPSA financing ‘s the bonus offered by government entities into the social servants. When you are part of they, you would not should miss it! Beginning to economically bundle of the satisfying the application form standards and you may choosing the maximum amount you could use. Keep in mind it’s also wise to ensure that your desired property is eligible to own an enthusiastic LPPSA loan.

Just after complete, be sure to surf the assets site ; there are many different the latest belongings on exactly how to choose from!