Troy Reichert

Troy Reichert possess Reichert Home loan LLC. With more than two decades regarding serving the us Airforce, Troy really wants to still give back into people by enabling bring anybody their best options within protecting a house.

FHA finance offer advanced level advantageous assets to individuals who are striving economically: down repayments only 3.5% and you will easy credit score criteria than the a conventional loan. But not, because your qualify for that loan doesn’t mean you have infinite borrowing from the bank resource. Basically, FHA mortgage constraints are different from the state and you can county.

As FHA-acknowledged lenders, The fresh Reichert Financial Cluster have a tendency to take you step-by-step through the whole home loan loan processes, away from preapproval so you’re able to signing your property loan application. For the majority of our own users, facts FHA mortgage constraints might have been vital because yourself affects the absolute most you could potentially acquire.

Just how try FHA Mortgage Limitations Determined?

According to Government Casing Loans Institution, compliant financing limits (CLL), which apply at Fannie mae and you may https://paydayloancolorado.net/johnstown/ Freddie Mac, are set annual, pursuing the guidelines lay of the Homes and you can Economic Recuperation Operate out-of 2008.

The fresh new FHFA subtracts the earlier year’s construction rates into the a certain urban area regarding the current year’s and you may exercise the difference since the an excellent payment. Mortgage limits for the reason that urban area following increase of the you to percentage. For additional information on the CLL try determined, check out the FHFA’s CLL Frequently asked questions.

During the lower-rates parts, FHA loan restrictions are set so you can 65% of this year’s conforming mortgage limit. Inside the high-rates components, the latest FHA financing limit is as much as 150% of one’s compliant financing restriction.

FHA Mortgage Limits 2023

To keep track enhanced home prices and value-of-life across the country, this new FHA improved loan limitations inside the 2023. The new standard matter, and therefore relates to really solitary-family members homes, risen up to $472,030, which is nearly a good $50,000 improve away from 2022.

The FHA loan restriction to have one-house within the large-cost portion became $step 1,089,3 hundred. You can find unique conditions created for Alaska, The state, Guam, therefore the U.S. Virgin Islands, the spot where the FHA hats single-nearest and dearest mortgage wide variety cap from the $step one,633,950.

Texas FHA Loan Limits within the 2023

FHA financing restrictions inside Texas differ based on the condition you inhabit and you will in the event the mortgaged residence is a one-device, two-product, three-equipment, otherwise four-device assets. The brand new FHA loan limits in 2023 cover anything from $472,030 having just one-device assets when you look at the Alamosa State, Fremont Condition, while some the spot where the cost-of-living is leaner.

On the top end, Eagle and you will Garfield Counties enjoys a loan limitation out-of $dos,067,850 for a four-product assets. To have Este Paso Condition customers, we possess the FHA financing constraints lower than.

2023 FHA Financing Limits in the Este Paso Condition, Colorado

Este Paso state financing limitations start from $517,five hundred getting a single-product property in order to $995,2 hundred to have a several-product assets. The average cost in the El Paso State is just about $478,886 since .

As casing rates go up by condition, the newest FHA, governed of the You.S. Company out-of Houses and you will Metropolitan Advancement, allows large loan constraints. That is why as to why different areas possess some other mortgage maximums.

FHA Financing Standards

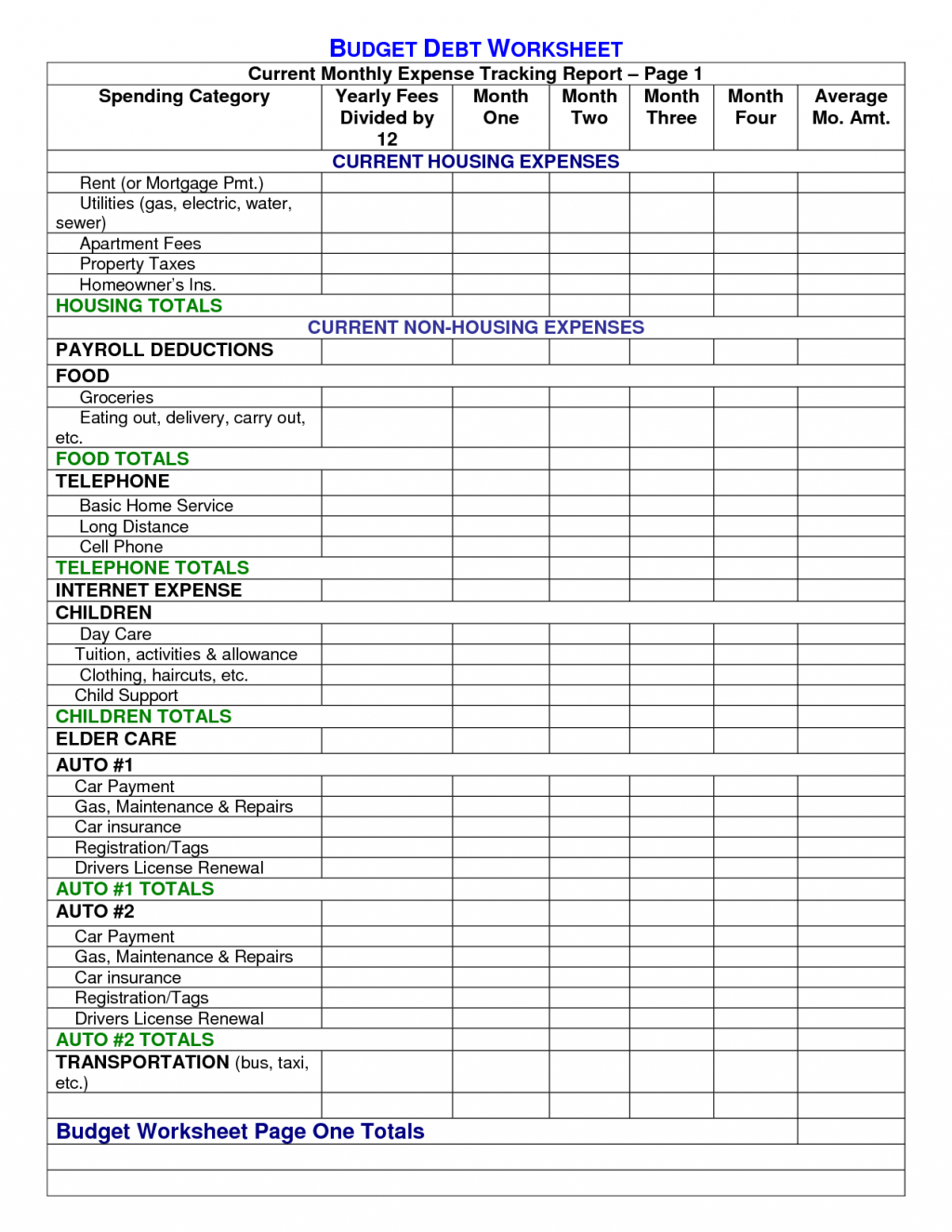

The debt-to-money proportion is the unmarried most important factor in choosing your FHA loan limitations, since it gives the loan financial a complete image of your own month-to-month investing. To choose the FHA loan maximum, loan providers commonly have a look at several important numbers that define the debt-to-income proportion: your own front end ratio and your back end ratio.

FHA loan constraints reference the maximum home loan amount a keen FHA lender could offer you, however you will still have to be eligible for an FHA mortgage. FHA loans much more easy regarding downpayment and borrowing from the bank score than many other financing versions, but you will still have to meet the pursuing the requirements:

- A credit history of at least 580 into low off commission option

- A deposit with a minimum of 3.5%

- A steady a position and you may money history for the past season

- A debt to help you earnings ratio of 43% or smaller

- The home must see FHA appraisal criteria

- Financial insurance rates on the mortgage

How you can see if your qualify for an enthusiastic FHA mortgage is to try to consult with a professional mortgage lender such as the Reichert Financial Class. Despite a national-backed financial, it’s still a good idea to shop additional loan providers to get the quintessential advantageous terminology to suit your condition.

Meet the requirements Now for your FHA Financing | The brand new Reichert Home loan Cluster

At The newest Reichert Home loan Group, we continuously inform our very own clients in regards to the mortgage techniques, plus one factor which is imperative to know are loan restrictions. FHA financing limits dictate the maximum credit potential, allowing you to buy house within your budget. We’d along with always discuss your loan alternatives along with you. FHA fund are a good substitute for family that simply don’t meet the requirements getting old-fashioned loan options, nonetheless could be more costly finally. If you have any queries about how precisely FHA funds works otherwise if the a keen FHA loan suits you, e mail us now! We had choose tune in to from you.