So what Are an enthusiastic FHA Financing?

FHA means Government Housing Administration. In simple terms, this is certainly financing program which is appealing to earliest-big date homeowners that is supported and insured from the federal government. Now it’s important to remember that this isn’t who will create the financing, your own financial is going to do one to, however, this might be an organization one manages helping individuals get for the the newest land. As well as really worth detailing not totally all loan providers is FHA qualified and never every FHA licensed lenders are the same in terms of rate of interest, charges, etc. Such whatever else, constantly shop around for the right package.

What are the Advantages of FHA Loans?

In terms of an FHA mortgage- What exactly is on it personally? A reduced down-payment! I am not sure in regards to you but growing up I consider before buying a house I’d need a complete boatload off dollars. Which have a keen FHA mortgage, the brand new deposit specifications is actually 3.5%. This is certainly incredible because your downpayment will come from an effective brand of supply together with your own discounts, financial merchandise out-of relatives or even in the type of off payment advice apps if you meet the requirements.

For individuals who skipped my previous overview of local deposit direction programs take a look at the blog post, Idaho first time home consumer software. FHA financing also are perfect for single nearest and dearest homes but also possible money services which you intend on residing and duplexes, triplexes and you will fourplexes. Discuss getting some help using your own mortgage repayment!

Also, it is well worth noting you to definitely as a keen FHA consumer, occasionally your settlement costs would be utilized in their amount borrowed and therefore that’s notably less bucks you have got to give at the closing. Possibly the seller of the house we need to buy can also be prefer to help donate to your result in. That is something you will have to negotiate on the bargain before purchasing your household. Which are the Disadvantages out of an FHA Home loan?

Do you know the Drawbacks from an enthusiastic FHA Financial?

Therefore most of these great things about this financing system- what’s the hook? Very, there are only one or two significant drawbacks with this specific form of mortgage. The original a person is the home you are searching to buy should be inside the pretty good shape before FHA tend to stretch away that loan. Very no leaking roofs, zero really trashed carpets, zero cracking paint- our home needs to be experienced habitable. Most likely, if you plan towards the selecting a whole fixer to suit your first put, you might have to you better think again the house otherwise remember a great 203k loan hence we are going to shelter in another post.

The past significant drawback is the amount of mortgage insurance policies you would have to shell out. While the authorities was support the borrowed funds- they wish to make sure they might be covered for those who standard to your mortgage and they have for taking back the home.

The insurance coverage generally comes in two-fold- towards first area, you only pay a premium at the close which is as much as step one.75% of your amount borrowed and certainly will become included on the mortgage by itself. Next part is for continued exposure, otherwise yearly premium, you need to pay monthly and that matter is included in your monthly mortgage repayment. Extent utilizes the size of the loan and the loan so you’re able to well worth ratio or LTV.

- LTV below otherwise equal to 95 %, yearly premiums is actually .80%

- LTV more than 95 per cent, annual premiums is .85%.

- LTV below otherwise equal to 90 percent, yearly premiums was .45%

- LTV above 90 %, annual premium are .70%

For those who intend on residing their house having an extended period of time will refinance in the future just after there is sufficient collateral and you will with respect to the types of financing your get up coming- this can eliminate the insurance rates requirement, so you commonly caught paying it for a lifetime.

FHA Mortgage Restrictions

- Single-family relations $271,050

- Duplex $347,000

- Triplex $419,425

- Fourplex $521,250

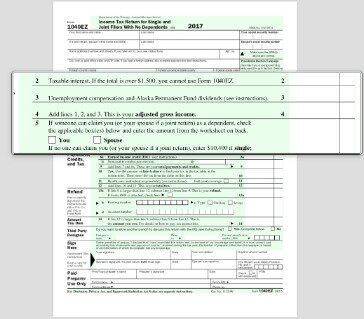

FHA Loan Criteria

Minimal credit ratings having FHA loans believe the kind of financing new debtor needs. To track down a home loan with an advance payment only step three.5 percent, the fresh borrower requires a credit rating with a minimum of 580.

- Need a reliable a job background, usually in identical type of really works, otherwise struggled to obtain a similar boss over the past 2 years.

When it comes to purchasing your family there are numerous selection available to you in terms of money. The only way to know what type is actually for you was to seek out counsel out-of a reliable lender. We could help walk you through the mortgage process. For lots more house consumer resources in addition to latest home loan prices head to proceed this link now our very own homebuyers resource webpage .

Lisa Kohl

Lisa Kohl are a full-time Boise, Idaho agent and you may Realtor. Lisa support customers purchase homes throughout the Idaho. Lisa would be contacted on (208) 391-4466. She would love the opportunity to express her regional degree and you will systems with you! We all know Boise A home will bring service in Boise and surrounding Idaho urban centers also Meridian, Eagle, Nampa, Kuna, Middleton, Star and Caldwell.