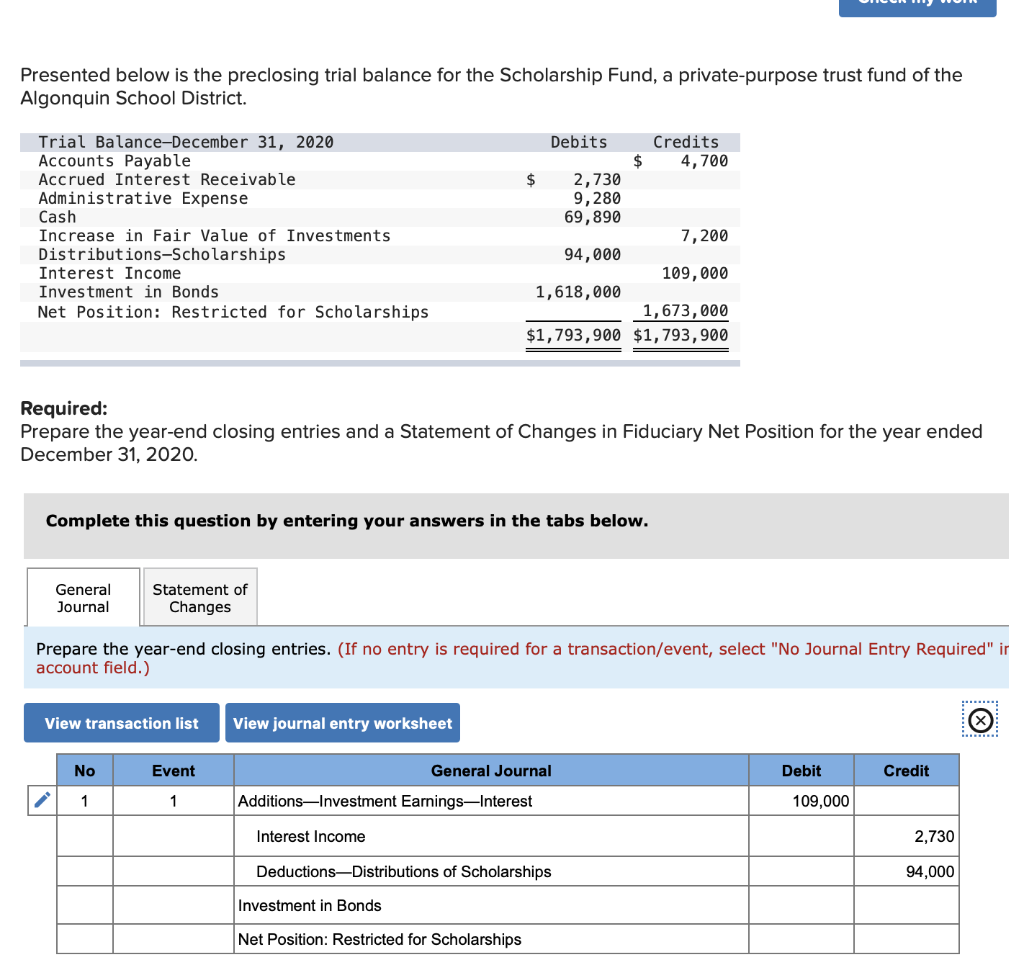

5. Consider to order financial activities

Home loan part, or dismiss products, is one way to lessen the cost of refinancing an excellent mortgage. To invest in this type of affairs will get reduce your rate of interest, but they are smart to propose to very own our home to your enough time-identity and don’t anticipate refinancing once more.

6. Go for original term insurer

Label prices try managed in a lot of You claims. However, you can try to slice off your own identity characteristics will set you back. Exactly how? Because of the asking your own term insurance company the amount of money it could costs in order to reissue the policy for the re-finance. This might cost not so much than carrying out more having a brandname-this new rules or mortgage lender. And you will, for many who didn’t score an user’s policy for the first mortgage, you have to know acquiring one for your refinance.

eight. Think of zero-closing-pricing re-finance

A no-closing-costs re-finance is a superb alternative if you find yourself lowest to the currency. While it is perhaps not 100 % free (as the term ways), no-closing-prices refinance mode you will not need to pay charges during the closure. Loan providers often as an alternative boost your interest otherwise through the closing will set you back on brand new home loan.

Typically, closing costs range from 2% so you’re able to 5% of the property loan amount. That it amount boasts 3rd-party charges and financial charge.

Refinancing really mode taking out a new financing to displace your dated you to definitely. Due to this fact, you wind up paying off of numerous mortgage-relevant fees and you will will set you back. These constantly through the loan origination payment, appraiser’s commission, credit history fee, application fee, and you can lawyer charges, and even more.

Such will set you back add up, and work out settlement costs excessive into the good refinance. It’s also possible to want to pay more charge such as for example discount products to lower your interest.

Will there be an approach to prevent closing costs when refinancing?

It’s impossible to eliminate settlement costs when refinancing. You usually have to pay all of them somewhere. However, you could choose between one or two options which have a zero-closing-cost re-finance:

- highest loan equilibrium

- increased financial cost

Understand that not totally all lenders give one another items out of no-closing-prices refinances. So it is vital that you guarantee ahead of time that bank can also be present the most common alternative.

Higher financing equilibrium

Their full financing harmony grows if you decide so you can move in the closing costs. Let’s say you are refinancing financing regarding $150,000, for-instance, which have $5,000 in closing costs. It indicates your brand-new equilibrium, with settlement costs included, could well be $155,000.

Now, let us glance at the difference between an excellent $155,000 re-finance and you will a beneficial $150 cashadvancecompass.com/personal-loans-nc/bolton/,000 re-finance from the an interest rate from 3.5%.

That have a loan name of fifteen years, their monthly payment might be roughly $1,072 getting a great refinance regarding $150,000. Complete with dominating and you can notice.

That have a beneficial $155,000 refinance, in addition, the payment per month for the very same loan label would-be on the $1,108. It means the real difference you will spend each month could be $thirty six. But not, additionally shell out a supplementary $1,434 from inside the appeal for good $155,000 refinance versus a great $150,000 refinance, considering the higher harmony.

But not, the increase is far less dramatic given that taking a higher rate of interest for a passing fancy amount, and this we’ll glance at today.

Improved home loan costs

If the home loan company provides a no-closing-rates re-finance rather than including finance on your prominent, you’re going to have to accept increased interest.

An elevated mortgage rates cannot change your prominent loan amount. not, you will spend much more fundamentally in the event the around are a small improvement in the rate of interest.

Instance, for those who re-finance your home to own $150,000 more an excellent fifteen-season identity at step three.5% attention, their closing costs manage normally be anywhere between dos% and you may six% of the total loan amount. With settlement costs around $six,000, at you to rate of interest, you’ll pay only more than $43,000 when you look at the attention throughout the re-finance. Whenever settlement costs are added, considering something nearer to $forty two,000.