A maximum 80% LTV are allowed by the FHA whenever their dollars-out refinance program is utilized. It indicates a separate financing are a maximum of 80% of one’s appraised property value your house.

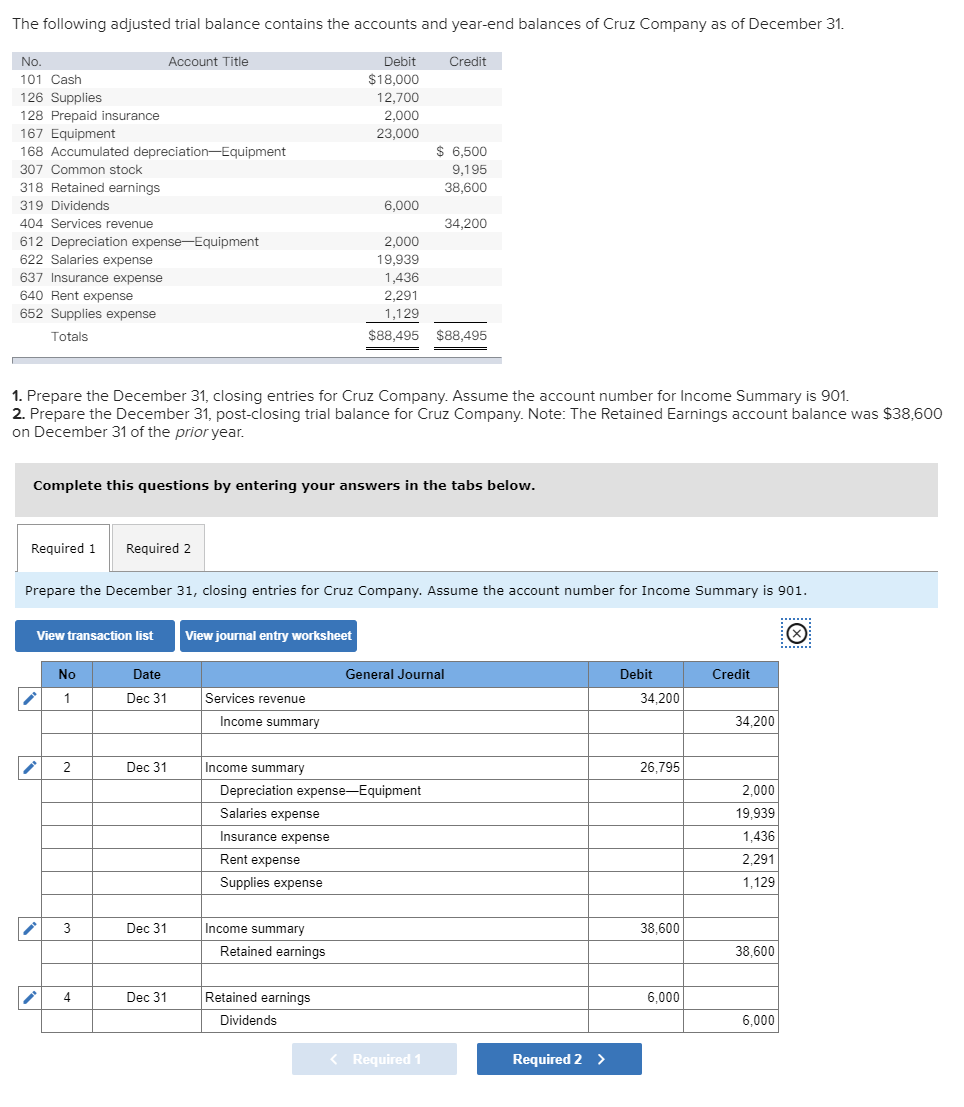

Although not, the new mortgage is required to become when you look at the mortgage limits put by the FHA. When your property value your property keeps rather preferred since you purchased it, then your quantity of your hard earned money-aside would-be capped because of the mortgage limitations place from the FHA.

Maximum maximum with the FHA financing in the most common areas of new country getting 2021 try $356,362. not, the maximum mortgage limits on one-equipment house can increase to help you all in all, $822,375 inside highest-worthy of real estate markets instance Nyc, Nyc, and you may Los angeles, Ca.

Just as much bucks you will get through the use of FHA cash-aside refinance is dependent on the newest security you have within the your residence.

Keep in mind that 20% of the house’s security have to be remaining due to the fact cash-right back has been taken. So when considering how much you happen to be capable sign up for. see the total security in your home and then deduct 20% and additionally settlement costs to bring about a price.

Pricing towards FHA cash-out refinances

According to Ice Mortgage Tech, financing application business, this new FHA’s repaired pricing mediocre as much as 0.10 to 0.15% (ten to fifteen basis circumstances) under conventional costs an average of. Which is as a result of the strong bodies backing provided by this new FHA. These types of funds is approved by the loan providers at straight down risk. not, FHA home loan insurance should be considered by the borrowers, which escalates the effective FHA prices since shown below:

FHA bucks-out loans might have high cost than the simple FHA finance. To get the best rates, consult with individuals loan providers.

FHA bucks-out versus antique cash-away re-finance

The biggest advantageous asset of using FHA cash-aside re-finance in place of a conventional bucks-away loan is that there are other easy credit conditions out-of this new FHA.

Technically, an enthusiastic FHA dollars-aside loan can be obtained having a credit history carrying out at the five-hundred. Yet not, it is inclined that lenders will start during the 580 so you can 600, and lots of you’ll begin during the 600. If you have a lowered credit history, attempt to be more comprehensive if you’re lookin having a lender that will agree your own refinance and provide your a reasonable speed.

Drawbacks on navigate to the web-site the FHA’s dollars-aside re-finance

Area of the drawback off an enthusiastic FHA cash-aside mortgage ‘s the home loan insurance coverage of this they. Both monthly and you can initial financial insurance costs are needed towards the FHA financing.

- Annual mortgage insurance policies: 0.85% of one’s yearly amount borrowed, paid-in twelve installment payments along with the homeloan payment

- Upfront financial insurance policies: 1.75% of the quantity of the brand new financing, paid up front side (always incorporated as part of the mortgage equilibrium)

In return for a lot more charge, far more credit score self-reliance exists from the FHA compared to antique finance. There is no monthly or initial financial insurance coverage having antique bucks-aside refinances. In addition to, FHA are only able to be studied to the home that you real time for the, when you are conventional financing could also be used for financial support functions and you may second residential property.

Ask your mortgage manager to evaluate mortgage terminology and choices to be sure you make the best option while unsure at which variety of refinance is best for your specific condition.

How do you have fun with an FHA cash-away re-finance

An FHA bucks-aside are often used to repay whichever loan, and just have take guarantee from the household and also have the currency wired for your requirements, or perhaps be awarded a. These fund may be used unconditionally.