“All of our well worth proposal extremely arrived right down to that phrase, that’s, you want to getting known for speed and you can provider using digital gadgets and you may tech,” said Sorochinsky, that is lead off mortgage financing on the $several.step 1 mil-asset DCU.

DCU technically revealed the brand new thinking-provider mortgage site when you look at the 2022 shortly after purchasing annually piloting the newest platform in order to fine tune the new techniques. The fresh new electronic lending program, mainly based by Nj-new jersey software company Blue Sage Possibilities, capitalizes into borrowing union’s “individual head” model by allowing possible consumers to try to get mortgage loans and you can domestic guarantee funds and refinance current money, without the need for a staff member.

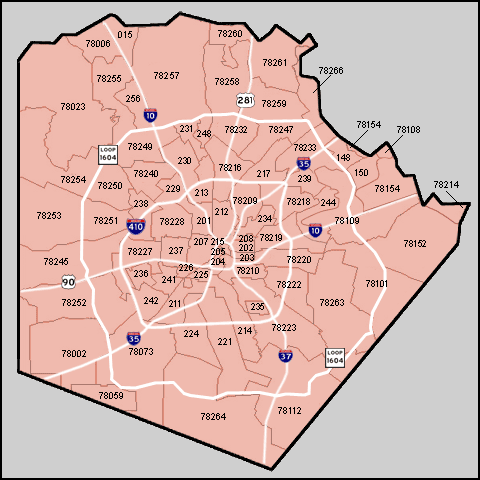

After searching for and therefore of the about three circumstances they wish to use to have, and you can inputting property information such as for instance zip code, expected advance payment and you can estimated cost, consumers are able to see the absolute most they might quote into the a great property and select hence cost and you will terms finest fit their needs. So it phase in addition to lets participants so you can electronically be sure their income, a career or other had property to help with its qualifications.

In application processes, consumers concerned with markets volatility is also secure their rate having fun with OptimalBlue’s price secure API, to possess fifteen to ninety days.

A secondary API contact with all the info characteristics company ClosingCorp will bring extra help by figuring application and you can assessment fees together with producing disclosure plans into affiliate so you’re able to signal.

Participants can get letters or sms compelling these to go-ahead to paydayloanalabama.com/langston a higher stages in DCU’s financial webpage and you may sign the latest needed variations following first software is submitted. Because charges is paid back, orders are positioned in for basic circumstances and label insurance rates, appraisals and you will ton permits, following another bullet regarding verification records try delivered back so you can the new applicant for finalizing.

Just after signing all of the necessary models, the newest file are submitted to this new underwriting agencies for further handling – hence DCU says you certainly can do in as little as 30 times and without needing a card relationship representative. Two-way correspondence which have an effective DCU financial credit manager, processor chip otherwise nearer through a talk means, and additionally educational videos, are available to improve user target one affairs.

“It doesn’t matter what brand new forces was, market meltdown or highest cost otherwise lower catalog, we can easily be profitable given that we have been emphasizing rates and you will service having fun with digital systems and you will technology,” Sorochinsky told you. By adding the fresh self-services portal, DCU was able to boost financing regarding around $step 1 mil within the mortgages whenever discussions began inside the 2019, to help you $step 1.6 billion inside the 2023.

DCU is regarded as a number of other establishments that have additional the latest innovation on the hopes of furthering registration progress and increasing loan regularity.

, instance, managed to develop core subscription of the twenty two% and increase dumps from the over $five-hundred billion in the a six-week period by using the latest York-dependent membership opening fintech MANTL’s deposit origination program. The newest Providence, Rhode Area-oriented

When Jason Sorochinsky first started converting the fresh new Marlborough, Massachusetts-created Electronic Government Credit Union’s mortgage origination process into the 2019, the guy realized that usually providing the low prices was not feasible

as signaled rate decreases will offer means to fix straight down home loan costs – spurring most recent individuals so you can re-finance getting a far more advantageous top.

“Now, individuals remember that a property is a fantastic financial support [as] it includes them the new versatility in order to make the place to find the goals, benefit from tax pros and create wealth over time,” Shultz said. “The chance to refinance the mortgage towards a lower rates when you look at the another 1-couple of years was possible.”

Advantages that have Cornerstone Advisors and you will Datos Skills underscored the significance of right research when vetting both 3rd-party companies together with circumstances it give the newest dining table, but similarly showcased the value of exploring the fresh new technology.

“It seems like a zero-brainer however, even with system prospective, of many underwriters nevertheless by hand eliminate credit and you will calculate rates by hand,” said Eric Weikart, lover on Cornerstone Advisers. “Both, it is because system setup points but many minutes it’s because they usually done they by doing this and so they aren’t happy to change.”

Next, DCU use Blue Sage’s combination on the home loan fintech Maximum Blue’s equipment and rates system make it possible for players to check on and you may come across the preferred mix of mortgage terms and cost

Automation is an important feature to possess underwriting applications getting truly energetic, but only with “total chance review, regulating compliance and you can clear advice” also set up, told you Stewart Watterson, strategic coach to possess Datos Understanding.

“Compared to the 20 or thirty years ago, consumers expect to have higher assumption out of price in order to approval and closure including wish to have a tech enabled techniques served from the educated, top-notch loan officials and processes teams,” said Christy Soukhamneut, head financing administrator on the $4 million-house College Federal Borrowing Relationship from inside the Austin. “The audience is definitely implementing home loan technical that is easy to use and you may user friendly so as that our very own conversion teams is concentrate on the member and you may advice mate feel.”