- Credit Concerns: A cards inquiry demands credit history suggestions out-of a cards bureau. Monetary groups make credit issues to loan places Frisco determine whether or not to agree a great debtor for a loan. The lending company runs a painful credit check assuming a borrower applies to have property collateral loan. A rise in comprehensive borrowing inquiries results in a credit rating elizabeth sorts of mortgage in this fourteen in order to 1 month is known as an individual query, minimize the fresh influence on fico scores.

- The brand new Borrowing from the bank: The borrowing from the bank describes this new borrowing membership regarding the credit report, such as for instance the latest playing cards and you may house equity fund. A property equity loan was an alternative borrowing membership throughout the credit history. The fresh new credit affect the FICO credit history because of the affecting ten% of your credit history if you find yourself healing over the years due to the fact loan many years.

- Borrowing from the bank use: Borrowing utilization is actually a dimension that suggests exactly how much regarding a good debtor’s offered credit is in explore. Credit application is essential from inside the figuring the financing get, making up more 30% of one’s FICO get and you may a life threatening varying immediately following commission records. Credit file have to monitor a diverse blend of money and credit notes, because it impacts ten% of one’s FICO get. A home security loan assists improve the borrowing from the bank mix and you may certainly affects credit scores.

- Diversity out-of profile: Variety regarding levels is the some borrowing from the bank levels included on the credit statement. A variety of borrowing from the bank profile facilitate the credit get, indicating loan providers one to a debtor covers different credit sensibly. A house equity financing advances the range out of profile regarding credit history, improving the credit rating.

The difference anywhere between a property equity loan to help you HELOC was finance disbursement, interest rate balances, cost build, and freedom. Family security money and Household Collateral Credit lines (HELOCs) create residents in order to borrow secured on its home’s security. Home collateral money render a lump sum payment initial, paid back owing to recurring installments more a-flat title, making the mortgage predictable and you may steady to have higher, only 1 expenditures eg tall family renovations or combining obligations. An effective HELOC loan properties such credit cards, providing a great revolving credit line which have variable rates and higher adaptability so you can lingering expenditures or unsure ideas for example studies or disaster money.

A loan provider offers a debtor a fixed-label financing according to research by the home’s security. Consumers sign up for an appartment number and get the currency upfront, with a predetermined interest rate and payment plan. The second financial really works eg a traditional fixed-price mortgage but needs sufficient collateral at home to qualify. The first mortgage should be paid sufficient.

A property Security Personal line of credit (HELOC) mortgage spends a beneficial homeowner’s family as security, enabling the fresh debtors in order to obtain as much as a specific amount against the latest residence’s well worth. Debtors only pay the interest into the wide variety borrowed and you may repay the remainder share in the event the funds are available.House security loans features repaired rates of interest, repaired repayments, and you will a lump sum payment, the improvement regarding household security loan so you’re able to HELOC. HELOCs keeps variable minimum fee quantity. Home equity fund want instantaneous payment in typical installments, when you’re HELOCs allow attention-simply money from inside the borrowing from the bank months. HELOCs allow multiple withdrawals away from a max count and you may request cost inside the focus-merely payments, when you’re home guarantee financing bring lump sum payment disbursement.

Why does property Equity Loan Really works?

- Home security money give straight down rates of interest than unsecured loans otherwise handmade cards, making certain monthly payments was foreseeable than the almost every other money.

What are the Criteria getting Household Security Fund?

- Sign the brand new closing data. Signal brand new closing data discussing the new conditions, interest, payment schedule, and you may costs. The mortgage money is provided to the newest borrower from inside the a lump share just after finalizing brand new records.

- Third Government Discounts & Loan: Third Federal Deals & Mortgage was an ohio-based bank providing household security money and you can credit lines that have no hidden fees, settlement costs, and you will a simple online app processes. The financial institution claims to conquer people lender’s speed otherwise pay the debtor $step 1,000. Third Government Savings & Financing also offers home security funds that have the very least Annual percentage rate out-of seven.29% for five-12 months family guarantee money. An excellent 10-12 months domestic guarantee financing provides a minimum Annual percentage rate from seven.59%, 7.79% to own good fifteen-12 months, and you can eight.99% to possess a great 20-12 months, allowing debtors to help you acquire between $10,000 and $3 hundred,000. 3rd Federal Savings & Mortgage does not publicly divulge minimal credit score requirement, even after loan providers requiring at least score from 620.

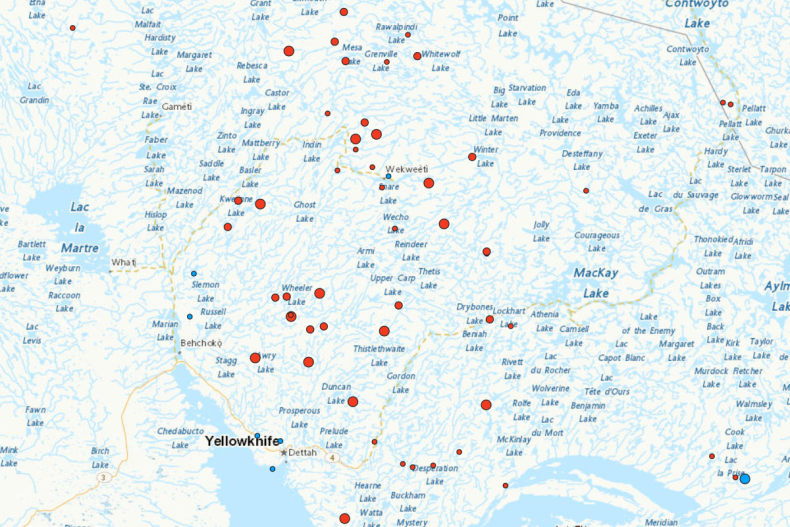

- Geographical Situations: Geographic area affects new prices, due to the fact loan providers provide other pricing considering county regulations and markets requirements. Check if the financial institution operates on debtor’s town and you can knows state-specific constraints. The newest approval procedure concerns evaluating creditworthiness, family value, and other monetary points to determine ount.

Calculating monthly obligations for household guarantee becomes necessary for budgeting, loan analysis, focus costs, loan label payment, and you will amortization schedule. Cost management lets individuals to know exactly how much of its money is familiar with pay off the mortgage, making certain affordability in the place of overspending. Payment per month calculation assists with mortgage comparison, given that various other lenders promote differing interest rates and you can conditions, making it possible for borrowers to find the most competitive mortgage solution.

Property equity mortgage are a secured loan, meaning that the home is employed once the security, and you may failing woefully to build payments timely puts the house at the exposure. Loan providers haven’t any direct restrictions on the using financing yet give certain criteria to have granting a property security financing, such the very least credit history, a maximum financing-to-really worth proportion, and you can a particular income.